Introduction to Vendor Finance in Australia

Think of Vendor Finance as like buying a cake, one slice at a time.

You can buy the whole cake, if you have the money to buy the whole cake.

But if you only have enough money to buy one slice, you buy one slice at a time.

If you buy one slice at a time, you can buy the whole cake over time.

It goes to show the old saying is right when it says:

You can have your cake and eat it too, if you buy one slice at a time!

Vendor Finance has been around a long time.

Here is the explainer video, and then below it the written commentary:

In Part 1 we take a look at how Vendor Finance originated and how it was used to sell land 100 years ago.

And then in Part 2, we take a look at how Vendor Finance is used today to buy and sell all kinds of real estate in Australia.

Part 1 - Vendor Finance in Australia 100 years ago

100 years ago, it was normal for vendors to offer easy payment terms when selling land in new subdivisions in Australia.

Payment terms were payment plans where the purchaser paid the purchase price to the vendor by instalments.

100 years ago, land in new subdivision was sold by public auction. All that a purchaser needed to bring along to the auction was a deposit. The vendor offered payment terms to pay the balance purchase price over 3, 4 or 5 years. No banks were needed.

The vendor financed the purchaser.

By offering payment terms, the vendor attracted more purchasers. That is, purchasers with only a deposit in their pocket would be able to buy land as well as purchasers who had the full purchase price.

Land subdividers made vast fortunes by offering easy payment terms when they sold land for housing in the new suburbs of Sydney and Melbourne, a tram ride away from the overcrowded inner city.

We are fortunate that the State Library of New South Wales has preserved many land sale posters from the land boom days 100 years ago.

Let’s look at some examples.

If you were buying land in 1910, you could buy at Arncliffe in the ‘Radium Estate’.

Look at the Terms: purchasers could pay one pound (£1) deposit and one pound (20 shillings) per month until the land was paid for. Interest was added at 4% per annum. It took 3 to 5 years to pay off the land.

If you had the full purchase price, you received a 5% price discount on the price.

Land Sale Poster Arncliffe (Wentworth & Gipps Streets) 1910

Terms Radium Estate Land Sale

Let’s head to Maroubra to a Crown Lands sale.

Don’t you love the beach babe on the top right-hand corner of the poster in her red dress and red headscarf?

In 1918, purchasers could buy land near Maroubra Beach on terms.

Look at the Terms: Some of the land had a reserve price of £4. Purchasers could pay a 25% deposit of £1 on signing the Contract and then pay 3 annual instalments of £1 each to pay the balance price, with interest at 5% pa added.

Land Sale Poster Maroubra - south of Maroubra Bay Road from Anzac Parade (“Broad Road”) up to Mons Street 1918

Maroubra Land Sale 1918 Payment Terms

You’ve all heard of Bondi Beach. In 1923, you could buy land to build a house close by Bondi Beach.

Look at the easy terms. Purchasers paid a 10% deposit and paid the balance price over 5 years by 20 equal quarterly instalments, with interest at 5% pa added.

If only your grandfather had bought a block of land! They are worth more than $3 million today.

Land Sale Poster Bondi Beach (Blair Street and Wallace Parade) 1923

Easy Terms Bondi Beach Land Sale 1923

Land was still being sold with payment terms in the early 1960s.

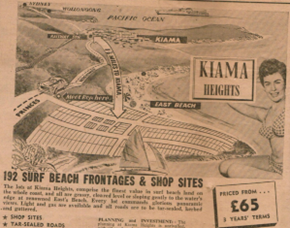

This is an advertisement for land for sale near the beach at Kiama Heights, on the NSW South Coast. The land was priced from £65, payable with 3 years’ terms.

Beach wear had changed for beach babes in the 1960s – they wore a polka dot bikini.

Land Sale Advertisement Kiama Heights early 1960s

What do the Land Sale posters tell us about Vendor Finance?

- There was always a deposit paid of between 10% to 25% of the price

- The payment terms were instalments over 3, 4 or 5 years

- Interest was payable at 4% pa or 5% pa

- If purchasers used payment terms, they paid the full price

- If purchasers paid in full, they received a price discount of 5%

- The paperwork was a Terms Contract, which these days is known as an Instalment Contract.

These days, banks and non-banks dominate the home loan market in Australia. The most popular home loan is a principal and interest loan repayable over 30 years. Except for the longer repayment period, today’s home loans look remarkably like the payment terms of 100 years ago.

Part 2 - Vendor Finance in Australia today

Let’s look at Vendor Finance in Australia as it is used today.

How does Vendor Finance work?

When a purchaser buys a house, they pay the purchase price in cash. That is, they pay the full price on completion of the Contract.

Cash does not mean a stack of $100 bills.

Cash means a cash deposit plus a home loan to help pay the purchase price.

If the purchaser is home loan ready because they have a steady income, can afford the loan repayments and have enough deposit, then they can purchase with cash with a home loan provided by a bank or non-bank lender.

But what if they are not home loan ready?

Why not try Vendor Finance?

Vendor Finance is a stepping-stone on the path to home ownership.

Vendor Finance is a payment plan where the purchaser makes regular payments which are a similar to home loan repayments. Vendor Finance is a payment plan where the purchaser starts with a small deposit which they build up. Vendor Finance is a stepping-stone because after a while, the purchaser will refinance with a home loan.

Why would a vendor give Vendor Finance?

It makes sense for a vendor to offer Vendor Finance where there are too many properties for sale and too few buyers.

Or it could be that the property is in poor condition, or is not zoned residential, or is damaged, or is in a place where postcode limits apply to restrict the amount of the loan.

Vendor Finance will make the property saleable at a good price, because it can attract purchasers who are not yet home loan ready. By increasing the pool of buyers, the vendor will not need to discount the price until they sell to a bargain hunter. A vendor who offers Vendor Finance benefits from a quick sale, often at a higher sale price because they are prepared to help with the first stepping-stone to home ownership.

Why would a purchaser want to use Vendor Finance?

It makes sense for a purchaser to use Vendor Finance if they are tired of renting but not yet home loan ready.

They may be able to afford the loan repayments but don’t have a have the steady income because they have not been in a job for long enough or own their own business (are self-employed). Or they don’t have enough deposit saved up.

And yet others might find that the bank won’t lend until a black mark on their credit file is removed (usually after 2 years have passed).

The major difficulty purchasers face in Australia is that not enough vendors know about Vendor Finance! As a result, enterprising purchasers are suggesting Vendor Finance to vendors, instead of waiting for vendors to offer payment terms.

The four kinds of Vendor Finance

Four kinds of Vendor Finance are used in Australia.

- Delayed Completion

- Carry-Back Loans

- Instalment Contracts

- Rent to Own

This is a brief introduction to each kind of Vendor Finance.

1. Delayed Completion (also known as Delayed Settlement)

Time is more valuable than Money when it comes to buying and selling real estate.

Delayed Completion is the Vendor Finance strategy which gives a purchaser time to find funds to pay the purchase price or obtain approvals.

It can also help a vendor.

Delayed Completion makes sense for a vendor because it gives them a good price and they need time to find a new home or build a new home.

Delayed Completion makes sense for a purchaser because it gives them time to sell their own home or raise funds from other sources, or to obtain a loan to pay the purchase price.

The Delayed Completion period will end with a simultaneous settlement of the purchase and sale.

Delayed completion is used for commercial property, to give a purchaser time to obtain planning approval or to find a tenant.

Delayed Completion is documented either as a Contract for Sale or a Property Option.

This is the link to the video:

Written commentary on the video:

2. Carry-Back Loans (Vendor Loans or Second Mortgage Carry-Back Loans)

A Carry-Back Loan is a vendor loan used to sell a property.

A good example is where the purchaser has a 10% deposit, but the bank requires a higher deposit of 20% or even 35%. If the bank requires 20%, and the purchaser has only a 10% deposit, there is a shortfall of 10% of the price.

The vendor steps in with a Carry-Back Loan for the 10% shortfall.

The Carry-Back Loan could be for a term of 6 months, 12 months, 24 months or longer after settlement. It might be more or less than 10% of the price.

A Carry-Back Loan is secured on the title by a second mortgage or a caveat.

A Carry-Back Loan is used by vendors of regional properties, high rise apartments, damaged properties and commercial properties.

This is the link to the video:

Written commentary on the video:

3. Instalment Contracts (also known as Terms Contracts)

Instalment Contracts are like buying a cake one slice at a time.

The purchaser pays the purchase price, one instalment at a time. The purchaser pays the instalments just like a home loan, except that the purchaser pays the vendor, not a bank.

100 years ago, when land was subdivided and sold, vendors advertised that the price could be paid with easy terms.

Purchasers would go to the land sale auction with a deposit in their pocket and pay the balance price to the vendor over 3, 4 or 5 years by quarterly instalments, with interest at 5% pa added.

The payment terms were documented as an Instalment Contract.

Today, when a home is sold using an Instalment Contract, the purchaser pays a deposit of 5% of the price and pays the balance purchase price of 95% by instalments of principal and interest over 30 years. That means 360 monthly payments.

An Instalment Contract is a good way for salary earners who have a steady income but low deposit to gain a foothold in the property market.

There is one major difference between purchasing with an Instalment Contract and with a home loan.

It is that with Vendor Finance, the title to the property remains in the name of the vendor until the Instalment Contract is paid out. That is the vendor’s security for payment.

It is different with home loan finance where the title to the property is transferred into the name of the purchaser, and the lender registers a Mortgage over the title as its security.

Because the purchaser is in occupation under the Instalment Contract, the purchaser is responsible to pay the outgoings - Council and Water Rates, Strata Levies, Insurance premiums, and looks after maintenance and repairs.

Although an Instalment Contract can continue for 30 years, it is normally paid out earlier. A purchaser will refinance with a home loan in a 5 to 10 year time frame when they have built up enough equity because a home loan is cheaper. Or they pay out the Vendor Finance loan when they sell and move on.

Warning – Instalment Contracts are not suitable to be used for properties in Victoria or South Australia.

This is the link to the video:

Written commentary on the video:

4. Rent to Own (also known as Rental Purchase or Rent-to-Buy or Lease Option)

Rent to Own helps a purchaser reach the goal of owning a house, while they are renting the house.

Rent to Own means that the purchaser rents the house, and at the same time, pays extra to build up a deposit to own the house. The time frame is usually 2 to 5 years.

The purchaser is pre-qualified by a mortgage broker. The pre-qualification will determine if the payments are affordable and also if the purchaser is likely to qualify for a home loan when the time comes to pay the price to own the house.

In a typical Rent to Own, the aim is that the purchaser will build up 20% equity in the property to qualify for a home loan at the end of the term. The equity can be built up by the extra payments, by renovations and by general increases in property values.

Rent to Own is a good way for the self-employed to gain a foothold in the property market because they need 20% equity to qualify for a home loan because their income is variable.

If there is insufficient equity at the end of the rental term of 2 to 5 years, a Carry-Back Loan can be used to bridge the gap between the deposit built up and the home loan available.

Warning – Rent to Own is not suitable to be used for properties in Victoria or South Australia.

This is a link to the video:

Written commentary on the video

Disclaimer

-

The video and written commentary contain general information and examples – they are not legal or investment or financial advice.

-

Do not rely on the video or written commentary to guide specific property purchases or investment decisions.

-

Professional advice is necessary for specific situations because property purchases and investment requires a careful evaluation of circumstances as well as due diligence in selecting and evaluating a property for purchase.

-

The paperwork for Vendor Finance needs to be prepared by a property law professional (a property lawyer or conveyancer). It is definitely not DIY (Do It Yourself).

-

The word ‘vendor’ is used in some States and Territories in Australia, while the word ‘seller’ is used elsewhere. The word ‘vendor’ is used to refer to both ‘vendor’ and ‘seller’ in the videos and the written commentary.

-

The same with the words ‘purchaser’ and ‘buyer’. The word ‘purchaser’ is used to refer to both in the videos and written commentary.