All about Rent to Own (also known as Rental Purchase or Rent-to-Buy or Lease Option)

How does Rent to Own work?

Rent to Own helps a purchaser reach the goal of owning a house, while they are renting the house.

Rent to Own means that the purchaser rents the house, and at the same time, pays extra to build up a deposit to own the house. The time frame is usually 2 to 5 years.

The purchaser is pre-qualified by a mortgage broker. The pre-qualification will determine if the payments are affordable and also if the purchaser is likely to qualify for a home loan when the time comes to pay the price to own the house.

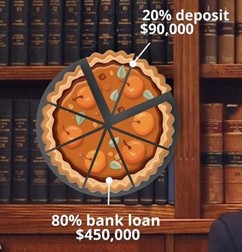

In a typical Rent to Own, the aim is that the purchaser will build up a 20% equity in the property to qualify for a home loan at the end of the term. The equity can be built up by the extra payments, by renovations and by general increases in property values.

Rent to Own is a good way for the self-employed to gain a foothold in the property market because they need 20% equity to qualify for a home loan because their income is variable.

If there is insufficient equity at the end of the rental term of 2 to 5 years, a Carry-Back Loan can be used to bridge the gap between the deposit built up and the home loan available.

Warning – Rent to Own is not suitable for use for properties in Victoria or South Australia.

When does a Rent to Own work?

Take this example:

A house is marketed as “Rent to Own”. Let us concentrate on the to own.

The price is $450,000, the deposit needed will be $90,000 (i.e. 20%) and the balance price $360,000 (i.e. 80%).

Under Rent to Own, the deposit is payable as to $20,000 up front, and as $70,000 by extra instalments of $200 per week payable on top of the rent of $400 per week.

It would take 350 weekly instalments of $200 per week, which is over 6 years and 38 weeks, to build up the $70,000 deposit.

More than 5 years is too long.

Assume that the instalments cannot be increased to be greater than $200 per week, for affordability reasons.

To speed up the process, the purchaser needs to build equity by carrying out renovations which would add value to the property, such as to paint, instal a new kitchen, and/or update the bathroom and do some landscaping.

The increase in value makes it feasible to obtain 80% bank finance in a shorter period. For instance, if the value increases by 10% to $495,000 because of the renovations, then a loan of 80% pf value would make a loan amount of $396,000 available.

How is Rent to Own structured?

Why do we choose an extra $200 per week, and not some other amount?

A good reason is that the mortgage broker (finance broker) has assessed that $600 per week (rent + option fee) is the loan repayment amount which is affordable for the purchaser.

The rule of thumb is therefore that the rent plus the option amount should be equivalent to the loan repayment for a bank loan.

Except for the rent, which can be tied to annual increases in CPI, the payments are fixed. There is none of the flexibility of an instalment contract where the payments can be varied according to increases and decreases in the interest rate used as the reference rate.

If at the end of the term the purchaser cannot borrow enough to pay out the balance price because the property value has not risen or not risen enough, or interest rates have risen, reducing the borrowing capacity, then the vendor can either extend the Rent to Own or provide a Carry-Back Loan for the shortfall to help the purchaser finance out.

It is recommended that the Rent to Own is managed by a real estate managing agent as a rental management. The managing agent will keep separate accounts, one for the rent, another for the option fee, and issue receipts to the tenant purchaser. This will make the Mortgage Broker’s job easy when the time comes to obtain finance. The managing agent will also ensure compliance with the Residential Tenancy Law.

The title to the property remains in the name of the vendor during a Rent to Own. If the tenant / purchaser wants to record their interest, they register a Caveat over the title.

Paperwork

The Rent to Own paperwork consists of two separate documents:

A Residential Lease for the rent part; and

A Property Option for the to own part.

Residential Lease: A standard Residential Tenancy Agreement is used - the form needs to comply with the Residential Tenancy Law. All the clauses are the standard clauses required by law.

The Residential Lease is for the agreed term. The rent payable is market rent and increases annually with inflation (CPI). A rental bond is paid.

The vendor (as landlord) cannot require the purchaser (as tenant) to contribute to Council and Water Rates or to the Insurance Premium, as this is contrary to the Residential Tenancy Law. Also, the vendor (as landlord) cannot make the tenant responsible to carry out maintenance and repairs under Residential Tenancy Law.

Property Option: This is a separate document, which gives the tenant/purchaser the right to purchase the property, for a fixed price, at any time until the end of the agreed term. The Option Deed needs to comply with the Sale of Land and Conveyancing Law.

It is a “Call Option” which means that the purchaser has the right to buy the house at the agreed price at any time until the call option expiry date. The purchase price is fixed up-front, which means that the purchaser keeps the increase in value. The term is made the same as the Residential Lease (less 1 day).

The purchaser pays an ‘upfront option fee’ when entering into the option to purchase. During the option term, the purchaser pays an ‘ongoing option fee’. The ongoing option fee is paid at the same time as the rent is paid. The ongoing option fee is fixed – it does not vary. A default in payment can result in the Property Option being terminated.

The option fees are credited against the deposit payable under the Contract for Sale, if the option to purchase is exercised. The option fees are non-refundable if the option is not exercised.

Legal notes

The rent paid under the Residential Lease and the option fees paid under the Property Option are released to the vendor immediately, instead of being held by a deposit holder until completion takes place.

Because the title to the property remains in the name of the vendor until the purchaser pays for the property, the tenant/purchaser protects their interest during the Rent to Own by registering a Caveat on the title. The Caveat prevents the vendor from selling the property to anyone else, or the vendor giving a mortgage over the property.

How does the purchaser go from renting to owning?

The purchaser takes the next step to ownership by exercising the option to purchase the property before it expires. To exercise the Option, the purchaser serves a Notice of Exercise of Option, a signed Contract for Sale, and pays any amount needed to ‘top up’ the deposit. The purchaser will have loan approval to pay the balance price payable for the property when they exercise the option.

When they exercise the option, the purchaser’s legal status changes from being the purchaser under an option to being the purchaser under a Contract for Sale. The property purchase then proceeds under the Contract in the normal way.

What happens if the purchaser defaults?

If the purchaser defaults by not paying the rent under the Residential Lease, then the default, termination and eviction procedures specified in the Residential Tenancy Laws need to be followed.

The Property Option will contain a clause that non-payment of the rent and termination of the Residential Lease are defaults under the Property Option, permitting the vendor to terminate the Property Option.

The Property Option can be independently terminated if the purchaser ceases to pay the option fees. Although in theory the purchaser could cease to pay the option fees but keep paying the rent, this rarely happens, so long as the rent is set at market rent at the start.

In some States, stamp duty in payable on Property Options. If so, the stamp duty is payable on the option fee.

Legal Restrictions

Rent to Own can be used without restriction in New South Wales, Queensland and Western Australia.

Restrictions apply in Victoria and in South Australia.

- In Victoria, ‘rent-to-buy transactions’ are prohibited for residential land (that is, houses, home units and vacant land). See section 29WC Sale of Land Act 1962 (Victoria).

- In South Australia, ‘rental purchase arrangements’ are unattractive because the payments are limited to 4 in number; and after 6 months, the purchaser can terminate the option and receive a refund of their money, if they change their mind. See section 6 Sale of Land (Conveyancing and Business) Act 1994 (South Australia).

Note: A Rent to Own arrangement documented by a Residential Tenancy Agreement and Property Option was upheld as valid by Associate Judge Harrison in the Supreme Court of New South Wales in the decision of Le v Tran [2016] NSWSC 632.

Disclaimer

- The video and written commentary contain general information and examples – they are not legal or investment or financial advice.

- Do not rely on the video or written commentary to guide specific property purchases or investment decisions.

- Professional advice is necessary for specific situations because property purchases and investment requires a careful evaluation of circumstances as well as due diligence in selecting and evaluating a property for purchase.

- The paperwork for Vendor Finance needs to be prepared by a property law professional (a property lawyer or conveyancer). It is definitely not DIY (Do It Yourself).

- The word ‘vendor’ is used in some States and Territories in Australia, while the word ‘seller’ is used elsewhere. The word ‘vendor’ is used to refer to both ‘vendor’ and ‘seller’ in the videos and the written commentary.

- The same with the words ‘purchaser’ and ‘buyer’. The word ‘purchaser’ is used to refer to both in the videos and written commentary