All about Carry-Back Loans (also known as Vendor Loans or Second Mortgage Carry-Back Loans)

How does a Carry-Back Loan work?

A Carry-Back Loan is a vendor loan used to sell a property.

A good example is where the purchaser has a 10% deposit, but the bank requires a higher deposit of 20%. The purchaser has a shortfall of 10%.

The vendor steps in with a Carry-Back Loan for the 10% shortfall.

The Carry-Back Loan could be for a term of 6 months, 12 months, 24 months or longer after settlement. It might be more or less than 10% of the price.

A Carry-Back Loan is secured on the title by a second mortgage or a caveat.

A Carry-Back Loan is used by vendors of regional properties, high rise apartments, damaged properties, development sites and commercial properties.

When do Carry-Back Loans work?

Carry-Back Loans work in these situations:

- If the property postcode is a place where the bank requires a higher deposit of 20% or even 35%, instead of the normal 10%. Postcode limits apply to regional towns (with a population of less than 2,000) and to rural properties. Lenders call them location categories (see notes at the end).

- If the property is an apartment in an inner-city development of more than 35/50 high-rise apartments (6 or more floors), lenders will require a 20% deposit.

- If the property is a strata apartment of less than 50 square metres (excluding balcony and car parking), lenders will require a 20% to 35% deposit.

- If the purchaser is self-employed, their lender will normally require a 20% deposit because their income is variable.

- If the house is in a flood-prone area or is in a bushfire prone zone, lenders may discount the value and require a 20% (or more) deposit.

- If the house has been damaged by fire, storm and tempest, flood water, falling trees or termites – even if the price is discounted, the bank might not lend more than 80% of the price until the property is repaired and habitable.

- If the property is a commercial property. – commercial lenders might lend only 65% of the value/price.

- If the property value falls after the Contract is entered into, and the purchaser’s lender lends less.

Note: the ‘value/price’ percentage is called Loan-to-Value Ratio (LVR) which means the percentage of the value/price that the bank lends.

Example - postcode limit

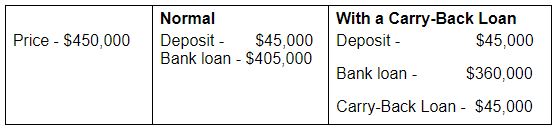

The purchaser decides to buy a house in a regional town or small rural acreage for a price of $450,000.

The purchaser has $45,000 to pay the 10% deposit. The purchaser has been pre-qualified by the bank for a loan of $405,000, which is the balance price payable.

The bank orders a valuation and tells the purchaser they will lend only $360,000. That is, 80% of the price, not 90% as the purchaser was expecting because a ‘postcode limit’ applies to the property. The purchaser does not have the extra 10% deposit and is devastated that they cannot go ahead with the purchase.

A Carry-Back Loan is the win-win solution because it provides the purchaser with the extra deposit needed. The vendor receives the price they want, and the purchaser can purchase the property.

It looks like this:

To repay the Carry-Back Loan, a purchaser will normally refinance their bank loan after 2 to 5 years, relying on an increase in the property value due to renovations and general increases in property values, or both. If not, the vendor can extend the time to repay the Carry-Back Loan.

A Carry-Back Loan can be advertised. For example, a high-rise apartment developer might advertise: ‘deposit finance available’ because they know that a postcode imit will apply.

Example – damaged house

A vendor is selling a house damaged by fire, storm and tempest, flood water, falling trees or termites.

If they sell ‘as is’, without renovation, they may sell at a price discount.

If they pay a builder to carry out renovation work, they may or may not increase the value by more than they spend on the work.

If they offer a Carry-Back Loan of 20% of the price, they may find a purchaser who has a 10% deposit, can borrow 70% from the Bank, and has funds to renovate the property.

Instead of the purchaser paying 20% of the price to the vendor on settlement, the purchaser keeps the money and spends it on the renovation. They will be looking to repay the Carry-Back Loan by refinancing once the renovation is complete by building equity in the property - increasing the property value by at least 20%.

The benefit to the vendor is that they don’t sell at a discount price by agreeing to delay receiving 20% of the price until 12 months after settlement, instead of receiving it at settlement.

How is a Carry-Back Loan structured?

Vendors don’t usually offer such payment arrangements. It is for purchasers to structure an offer in a way that a sale with a Carry-Back Loan appeals to a vendor because they receive a higher sale price than a cash sale.

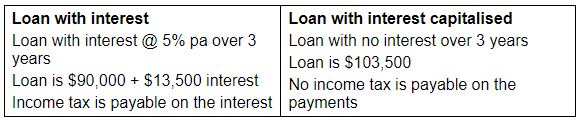

The interest rate for the Carry-Back Loan will be similar to the interest rate for the bank loan the purchaser takes out for the property. The interest rate can be fixed or variable. Usually, interest is payable monthly.

The loan amount payable at the end of the term is often called a “balloon” payment.

A plan needs to be discussed up front with the purchaser to make sure they will be in a position to pay the balloon payment, when the time comes.

A pro-active plan is that the purchaser agrees to make improvements to build up equity, so as to increase the property value by at least the amount of the Carry-Back Loan. Any general increase in property values is a bonus, not part of the plan. If it is not possible to refinance to pay out the loan at the end of the term, the vendor needs to offer to extend the loan repayment date.

A mortgage broker needs to be involved when discussing the plan to find out if the plan is feasible. The broker will need to be satisfied that the purchaser’s income will support the higher repayments needed to service the refinanced loan. The broker will also need to be satisfied that the lender who advances the bank loan will not object to the Carry-Back Loan.

Some vendors prefer to capitalise the interest. That is, to make the interest payments capital instead of income for income tax purposes. Compare these:

The same monthly payment amount of $375 per month is payable in both situations, but tax is payable by the vendor in one and not in the other. If the interest is capitalised, capital gains tax may be payable. But capital gains tax is payable at half the rate, if the vendor has owned the property for at least one year, or not at all if the property was their home.

The title to the property transfers from the name of the vendor to the purchaser when the Contract is completed. As a result, the Carry-Back Loan needs to be secured.

The Carry-Back Loan is secured by a second mortgage registered over the title, ranking immediately after the first mortgage registered by the bank to secure the bank loan.

The first mortgage bank’s consent should be obtained to the Carry-Back Loan.

The Paperwork

The paperwork is loan contract with a mortgage.

The loan contract contains the loan terms: the loan amount, the term, the interest rate, how changes to the interest rate are made, the loan repayment amount, dates for payment and various financial default clauses. The loan contract should contain the disclosures and the documents required by the National Credit Code.

The mortgage also contains the security terms, known as mortgage covenants. The mortgage covenants create property related obligations, such as the obligation to keep the property in good repair, keep it insured, pay rates as they fall due. There will be covenants dealing with defaults, not only property defaults but also financial defaults, such as loan repayment defaults and bankruptcy.

Legal Notes

The mortgage is the vendor’s security for the Carry-Back Loan. It is registered as a second mortgage on the title to the property, which means that it ranks after the first mortgage the purchaser has given to the bank.

A caveat can be registered instead of a mortgage but is marginally less secure because a caveat can be removed more easily than a mortgage from the title.

If the purchaser defaults under the Carry-Back Loan, then the vendor can take debt recovery proceedings, but is usually not able to sell the property because first mortgagee will exercise their power of sale under the first mortgage.

Usually, the vendor waits for either the purchaser to sell the property or for the first mortgagee to sell the property. The first mortgagee will evict the purchaser, and carry out the sale, and pay all of the expenses involved. If the first mortgagee won’t exercise its power of sale, then the vendor, as second mortgagee can step in.

The vendor takes the risk that there may not be sufficient proceeds of sale to repay the Carry-Back Loan if there is a forced sale, or if property values decline. That risk needs to be managed when the Carry-Back Loan is agreed – by having the purchaser pay the 10% deposit from their own money to create a buffer against loss.

Legal Restrictions

Carry-Back Loans are credit contracts which are governed by the National Credit Act and National Credit Code, that is, under the National Consumer Credit Protection Act 2009 (Commonwealth) which applies throughout Australia.

The National Credit Act requires that lenders to make “reasonable inquiries about a consumer's financial situation, and their requirements and objectives” - that is, follow the responsible lending rules to make sure that the loan repayments are affordable. A mortgage broker / finance broker (an Australian Credit Licence holder) will be able to carry out the credit assessment according to responsible credit rules.

The National Credit Code requires lenders to give credit disclosures and documents to borrowers which give information about the vendor finance – such as expected loan repayments, total cost of the loan, features and upfront fees. The loan offer and mortgage for the Carry-Back Loan should contain these credit disclosures and documents.

A vendor does not need to hold an Australian Credit Licence to give a ‘one-off’ or even ‘two-off’ or “three-off” Carry-Back Loan, so long as the vendor is using the Carry-Back loan as a means to sell the property and is not carrying on business of providing credit.

This was illustrated in a NSW Supreme Court decision upon Carry-Back Loan which was used in a one-off house sale. Justice Adamson said that the vendors: “were engaged in … an isolated transaction for personal reasons. They were not conducting a business of providing credit” and therefore did not need to hold an Australian Credit Licence. - Gray v Latter [2014] NSWSC 122.

Having said that, the vendor must still comply with the National Credit Code. They need to issue a loan statement every six months, and deal with hardship applications in the same way as home loan lenders must.

What are Location Categories?

Have you wondered what rules lenders have for lending according to location? They are:

Each lender and Lenders Mortgage Insurance (LMI) provider has a guide that assigns a category for each postcode in Australia. There are typically five categories:

-

Metro Plus: Established properties in well sought after metropolitan locations. Very low risk.

-

Category 1: Metro areas, capital cities in each state & major regional centres with a large population. Generally considered to be low risk.

-

Category 2: Medium-sized regional centres. Considered to be low to medium risk.

-

Category 3: Smaller towns with fluctuating property markets. Considered to be medium to high risk.

-

No Category / National Locations: All other postcodes that aren’t included in the above categories. Considered to be very high risk.

-

High Density: Inner-city suburbs or areas with high rise residential buildings. High-density units in these areas are considered to be very high risk.

A particular area or postcode may have different classifications for different lenders depending on their interpretation of the property market in that area.

Some lenders will also take historical data into account.

Disclaimer

- The video and written commentary contain general information and examples – they are not legal or investment or financial advice.

- Do not rely on the video or written commentary to guide specific property purchases or investment decisions.

- Professional advice is necessary for specific situations because property purchases and investment requires a careful evaluation of circumstances as well as due diligence in selecting and evaluating a property for purchase.

- The paperwork for Vendor Finance needs to be prepared by a property law professional (a property lawyer or conveyancer). It is definitely not DIY (Do It Yourself).

- The word ‘vendor’ is used in some States and Territories in Australia, while the word ‘seller’ is used elsewhere. The word ‘vendor’ is used to refer to both ‘vendor’ and ‘seller’ in the videos and the written commentary.

- The same with the words ‘purchaser’ and ‘buyer’. The word ‘purchaser’ is used to refer to both in the videos and written commentary